Retail Knowledge

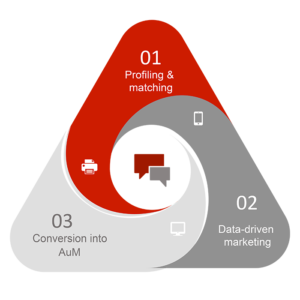

Our Risk Matching Algorithms characterise an investment in terms of its underlying risk profile and use statistical techniques to identify suitable investors.

Take control: employ your own evidence based marketing campaigns

STEP 1: Matching Funds With Investor Profiles

Fund characteristics

Performance/Volatility

Capital Appreciation/Preservation

Hedged/Traditional

Active/Passive

Market/Theme

Investor profiles

Sociodemographic

Net worth

Risk tolerance

Investment goals

Behaviours, Interests…

« Bottom up » – Turbodex builds a unique profile from a fund manager’s CRM information and investor insights which are all tested against each other to establish correlations and leading patterns

« Top down » – Smart data sources & models segment potential investors into groups according to the investment product or fund. Variables analysed include demographics, wealth, location, education, memberships, online behaviour, investor experience…

STEP 2: Data Driven Campaigns

-

- Investor profiles updated in real-time for onmi-channel marketing

-

- Plan, price, manage on Demand Side Platforms using machine-learning solutions for achieving performance targets

STEP 3: Conversion

Enriching data

Enrich the asset manager’s investor profile and provide new leads leveraging smart complimentary data sources, digital media analytics and online marketing techniques.

Coordinate with sales & marketing teams on how best to communicate and engage investors to convert these leads into AuM (channel, direct sales, surveys, promotions, conferences, research, targeted display ads…).

Value ladder

Analyze the entire sales funnel and see how to best migrate clients from initiation (promotional offers) to completion (conversion into investors in your funds).